President Tebboune’s Robust Agenda for Energy Security: Elevating Algeria’s Global Position while Ensuring Sovereignty and National Security

BY: Dr. Hana Saada

Algeria, October 9, 2023 – Following assuming power in December 2019, the President of the Republic, Abdelmadjid Tebboune, initiated an extensive series of reforms. These efforts culminated in the adoption of a new constitution in December 2020 and the subsequent election of a new parliament in June 2021. President Tebboune also expressed his commitment to addressing economic concerns. Consequently, New Algeria embarked on an ambitious reform program to enhance its legal framework, aiming to stimulate comprehensive investments and achieve economic recovery. The success of this endeavor is inevitably attributed to the prudent and forward-thinking policies pursued by the country’s highest authorities, led by President Abdelmadjid Tebboune, who also serves as the Commander-in-Chief of the Armed Forces and the Minister of National Defense.

Recognizing that economic recovery hinged on ensuring energy security, Algeria ratified a new hydrocarbons law to address the deficiencies in the previous 2005 Hydrocarbons Law and related tax regulations, especially since energy security has emerged as a contemporary facet of comprehensive security, as per the United Nations’ definition: ‘the condition in which energy resources are consistently accessible in ample quantities and at reasonable costs.’ This concept represents a pivotal hurdle and a cornerstone of national security for nations. Furthermore, it stands as one of the prominent global challenges that nations will confront in the foreseeable future. Algeria, for its part, has taken practical steps by addressing its domestic requirements and actively participating in the preservation of global energy security, leveraging its strategic geopolitical positioning.

To this end, Algeria’s Hydrocarbon Law No. 19–13 of December 11, 2019 is primarily aimed at revitalizing investment in the hydrocarbon sector. Prior to its enactment, Algeria faced challenges in attracting substantial investments in the hydrocarbon industry. These challenges stemmed from various factors, including the country’s regulatory and fiscal framework for oil and gas, a decline in exploration efforts, particularly in a context characterized by sustained drops in crude oil prices, and heightened competition among oil-producing nations to attract new investors.

President Tebboune’ Strategic Focus on Energy Security

President Tebboune has consistently placed the energy sector as a top priority, guided by concrete data that underscores its immense significance. Notably, energy constitutes approximately 60% of public treasury revenues and 96% of total national exports. This data underscores the central role that energy plays in Algeria’s national economy.

Algeria’s prominence on the global energy stage is indisputable, as it ranks 18th in the world for oil production and 9th for gas production. Algeria possesses a well-established energy sector that offers diverse investment opportunities in fields such as oil, gas, renewable energy, and electricity distribution. The country is endowed with substantial natural resources, including about 159 trillion cubic feet of natural gas and 12.2 billion barrels of oil reserves. Currently, Algeria maintains a daily production rate of approximately 970,000 barrels of oil and 9.9 billion cubic meters of gas.

Moreover, Algeria is actively advancing its renewable energy sector to generate clean electricity, capitalizing on its significant oil and gas revenues. As of 2023, Algeria stands as the fifth-largest global exporter of liquefied gas, making a substantial contribution to Africa’s liquefied gas production. Alongside Nigeria, Libya, and Egypt, Algeria accounts for over 80% of the continent’s liquefied gas output. This firmly establishes Algeria as a key player on the global energy map.

In this context, the President has consistently stressed the paramount importance of ensuring energy security. He has outlined a clear vision that encompasses expanding and advancing research and exploration, fulfilling international market commitments, and aligning with the evolving landscape of the energy transition. These priorities leverage the abundant resources in non-conventional energies that our nation possesses.

To pursue these objectives and implement a comprehensive strategy, President Tebboune swiftly established the Supreme Council of Energy. This council plays a crucial role in shaping energy policy and ensuring energy security within the country. It oversees the national energy market with precision and purpose, ensuring that Algeria’s energy sector remains robust and adaptable to changing global dynamics.

Sonatrach, Lever of National Sovereignty, Embraces New Legislation to Energize Investment

Since the adoption of the new legislation, Algeria has successfully reversed the declining trend of foreign investments in its energy sector, thanks to enhanced contract terms and more favorable tax rates. This has resulted in the establishment of a more organized petroleum framework and a tax regime that appeals to investors, solidifying Algeria’s position in the regional and global oil and gas markets. Under the updated legal framework, the tax burden on Sonatrach, the state-owned oil company, and its international partners has been reduced significantly.

Due to the aforementioned reforms, Sonatrach, the Algerian state-owned oil producer, has successfully expanded its production, renegotiated pricing arrangements, and forged new export agreements. This has led to unprecedented levels of production and a significant financial gain. A comparison with the past reveals a substantial increase in the number of contracts concluded. Despite four amendments to the 2005 law in 2006, 2013, 2014, and 2015, this law still imposed high taxes and duties on exploration and production activities, along with unclear contract-sharing arrangements with Sonatrach, the national oil company. Consequently, Algeria struggled to attract foreign investors, with statistics indicating that since 2010, the average number of new contracts signed per year has dropped to just two.

In response to this challenging situation, the introduction of the New Law revitalized the energy sector, making it more appealing to foreign investors. Sonatrach, as the driving force behind the national economy and an internationally integrated entity, has inked numerous agreements with major oil companies from Italy, Russia, China, Spain, France, and others. Sonatrach operates across more than 150 oil and gas fields, with a network of 22,000 kilometers of pipelines, four natural gas liquefaction facilities boasting a capacity exceeding 50 million cubic meters per year, a range of refineries in Algeria with an annual capacity of over 30 million metric tons, and extensive infrastructure including gas pipelines, ships, and port facilities. These assets allow Sonatrach to maintain its export levels while ensuring the domestic market’s energy supply.

Sonatrach’s 2022 Success: Unveiling 15 New Hydrocarbon Discoveries in Annual Report

Sonatrach has unveiled a significant array of fresh hydrocarbon findings, poised to bolster Algeria’s hydrocarbon reserves and enhance its global standing as a dependable hydrocarbon provider, especially within a global landscape characterized by robust demand. Over the span of 2020 to 2022, a remarkable total of 35 novel hydrocarbon discoveries was registered, with an impressive number originating from the giant oil firm’s own exploration endeavors.

Besides, the 2022 report on Sonatrach’s performance has been publicly disclosed, providing comprehensive insights into the oil company’s developments. Of notable significance in this document are the hydrocarbon discoveries, totaling 15 in the past year, including 3 achieved through partnerships. These discoveries are predominantly concentrated in the most prolific oil and gas basins, namely Oued Mya, Amguid Messaoud, Berkine, and Illizi, situated in the southeastern region of the country.

In specific terms, within the Oued Mya basin, Sonatrach reported two oil discoveries, while the Amguid Messaoud basin also yielded two oil discoveries. The Berkine basin contributed five oil discoveries, including three in collaboration with partners, and the Illizi basin unveiled two discoveries, one of gas and the other of gas condensate. Moving to the southwest, Sonatrach recorded a gas discovery in the Béchar Oued Namouss basin and an oil discovery in the Tindouf-Reggane-Sbaa basins. In the northern part of the country, an oil discovery was made in the southern Constantine basin. These discoveries collectively revealed a hydrocarbon volume equivalent to 117.6 million TEP (Tonnes of Oil Equivalent), with 86% being oil and 14% gas.

In terms of investments, Sonatrach committed a total of $5.6 billion in 2022, reflecting an 11% increase compared to 2021. Within this investment, $4.8 billion was allocated to exploration and production, with $3.5 billion being self-funded efforts and $1.3 billion coming from partnerships with foreign companies. Notably, Sonatrach’s investment in exploration alone reached $708 million, marking a 52% increase from the previous year. It’s worth highlighting that foreign partners’ investments in exploration have declined, possibly due to delays in implementing new hydrocarbon regulations and launching fresh exploration tenders targeted at foreign investors. Of the 37 exploration drilling wells completed in 2022, only 5 were carried out in collaboration with foreign firms. This stands in contrast to the development of oil and gas fields, where 40 out of 112 development wells were drilled in partnership with foreign companies. Consequently, there remains an imperative to encourage greater involvement of foreign companies in Algeria to stimulate research and development activities in hydrocarbon resources, potentially accelerating the discovery of new oil and gas reserves.

In terms of financial performance, Sonatrach achieved foreign exchange earnings totaling approximately $59.8 billion from exports in 2022, significantly boosted by the surge in oil prices throughout the year. This upturn was notably driven by the average price of an Algerian barrel of Sahara Blend, which stood at $103.90 during the fiscal year. Tax contributions to the Treasury from oil amounted to 5,548 billion dinars, roughly equivalent to nearly $39 billion, reflecting a substantial 113% increase. Sonatrach’s net profit for the year reached $10 billion.

Additionally, the national company reported a hydrocarbon production of 189.6 million metric tons of oil equivalent (TEP) in 2022, signifying a 2.4% increase compared to 2021. In the preceding year, production amounted to 185.2 million TOE, compared to 175.9 million TOE in 2020, suggesting a gradual upward trajectory in hydrocarbon production.

Sonatrach Achieves Remarkable $21 Billion in Export Turnover in the First 5 Months of 2023

Sonatrach reported an impressive export turnover of $21 billion during the first five months of 2023, as revealed in a publicly disclosed report that showcased the company’s achievements.

By the end of May 2023, the total marketed production has reached 68 million tonnes of oil equivalent (TOE), representing a 2% increase from the previous year. Out of this production, 38 million tons were exported. This export figure, which included both crude oil and gas, exceeded the corresponding period in 2022, when the company exported 37 million TOE out of a total of 67 million TOE.

The primary production of hydrocarbons also saw a 2% rise, reaching 80 million TOE by the end of May 2023, compared to 79 million TOE during the same period in the previous year.

Additionally, the report highlighted the export of 170,000 metric tons of gasoline during this period, emphasizing that the national fuel demand was entirely met without the need for imports for the third consecutive year. Sonatrach’s import activities were limited to MTBE and Ethylene in 2023.

During the first five months of 2023, Sonatrach made eight significant hydrocarbon discoveries, with seven of them achieved through the company’s own efforts. Furthermore, the company signed exploration and production contracts, including the fourth contract operating under the new hydrocarbons law (19-13), in collaboration with PERTAMINA and REPSOL, focusing on the Menzel Ledjmat Nord area.

Sonatrach also solidified its global presence by entering into strategic agreements with the Italian group ENI, which aimed at increasing gas supplies and reducing emissions. Memoranda of understanding were signed to enhance cooperation with the Brazilian company WEG S.A and the Chinese company CC7, focusing on feasibility studies for a petrochemical feedstock steam cracking complex.

In addition, Sonatrach established cooperative ties with the Uganda National Petroleum Company in the hydrocarbons sector and secured a contract with the Wanhua Chemical Group for the supply of LPG.

The report also mentioned key projects that were commissioned and initiated during this period. Notable among them were the South West gas field developments in Hassi Tidjerane, Tinerkouk, and Hassi Ba Hamou. Moreover, the company embarked on important projects such as the rehabilitation of the CNDG and CDHL pipeline transport systems and the construction of the PDH/PP Arzew petrochemical complex.

On another level, Sonatrach is actively engaged in discussions with major energy firms to promote shale gas exploration. Concurrently, it is gearing up for the next licensing round, capitalizing on the substantial estimated reserves of 20 trillion cubic meters, or 707 trillion cubic feet (tcf) of technically recoverable resources within its borders, which rank as the third largest globally.

These reserves represent a significant potential for both domestic use and exportation, making them an attractive prospect for international companies aiming to capitalize on the increasing demand for natural gas. These shale deposits are primarily situated in the Ahnet, Timimoun, and Reggane basins, containing substantial quantities of recoverable gas resources.

Algeria, a prominent member of the North African Energy Community, finds itself favorably situated to supply energy to neighboring markets like Mali, Niger, and Tunisia, as indicated in the “Energy Capital and Power” report. Beyond being a significant global exporter of oil and gas to international markets, Algeria has been committed to fostering energy cooperation and investments throughout Africa. It achieves this by offering various support mechanisms and high-level technical assistance to emerging energy players.

Presently, the nation has support initiatives in place with countries such as Uganda, Tanzania, Kenya, and Zimbabwe, encompassing workforce training, financial backing, and investment, while extending services across exploration and production, transportation and distribution, and refining sectors. This support will play a pivotal role in advancing nascent oil and gas markets across the African continent.

Algeria’s Thriving Minerals and Mining Sector: A Catalyst for Economic Prosperity

Algeria heavily relies on its thriving minerals and mining sector to fuel its economic growth and secure prosperous lives for its citizens, both now and in the future. The sector is experiencing continuous advancement, thanks in large part to the Ministry of Energy and Mines’ systematic efforts to harness the nation’s abundant natural resources. This strategy encompasses various facets designed to propel the sector forward.

Within Algeria’s minerals and mining sector, pivotal projects serve as the linchpin for the country’s mining activities, delivering substantial contributions to the national economy by extracting essential minerals, according to reports from specialized energy sources.

Algeria’s ambitions extend to launching additional mining ventures, with a focus on extracting substantial quantities of diverse minerals. Among the most notable minerals in this endeavor are iron ore, steel, phosphate, zinc, lead, and other pivotal resources.

According to the advisor to the Algerian Ministry of Energy and Mines, the minerals and mining sector in Algeria operates according to a comprehensive national strategy. This strategy rests on three fundamental pillars:

First: Research and Exploration

Between 2021 and 2023, Algeria successfully initiated 26 mining research projects across 27 provinces, aimed at exploring nine critical minerals pivotal to the national economy. These minerals include substances previously imported by Algeria, now integrated into the nation’s industrial cycle.

Second: Enhancing Algeria’s Geological Map

To comply with President Abdelmadjid Tebboune’s directives, particularly the “54 Commitments,” the minerals and mining sector in Algeria is actively working to enhance the country’s geological map. This initiative underscores the significance of developing the mining sector.

Third: Implementing Tangible Projects

The third pillar of the national strategy involves bringing projects to life on the ground. This step is a practical translation of Algeria’s vision for its minerals and mining sector, aiming to leverage all available resources and capabilities to diversify and develop the national economy.

Notable Mining Ventures in Algeria

The minerals and mining sector in Algeria encompasses several noteworthy projects, each vying to bolster the sector, unlock its full potential, and derive optimal economic and productive benefits. This pursuit aligns with the nation’s goal of achieving self-sufficiency in essential minerals, thereby reducing reliance on imports.

1. Ghara Djebilet Project

Situated in Tindouf, the Ghara Djebilet project is among the standout ventures in Algeria’s minerals and mining sector. Spanning an extensive 50,000-hectare area, it boasts significant reserves, notably an estimated 3 billion tons of iron ore, including 1.75 billion tons of exploitable reserves adhering to international mining standards.

The project aspires to produce a substantial 12 million tons of steel by 2025, necessitating a supply of 20 million tons of iron ore (4 million tons of iron concentrate and 6 million tons of pellets), before scaling up to 40 million tons of iron ore by 2040.

Ghara Djebilet also contributes significantly to employment, with about 5,000 direct jobs and an additional 20,000 indirect jobs. Initial investment costs are projected to fall between 7 and 10 billion dollars, as per the Algerian Ministry of Energy and Mines.

It’s noteworthy that on April 13, 2023, the Algerian Minister of Energy and Mines, Mohamed Arkab, oversaw the signing of a memorandum of understanding to establish an iron ore concentrate production unit in the Ghara Djebilet mine. The partnership between the National Iron and Steel Corporation (FERAL) and the Turkish Tosyali Complex aims to produce up to 500,000 tons annually within 24 months, supplying the Tosyali iron and steel complex in Oran.

2. Phosphate Exploitation Project in the Bled El-Hedba (Tébessa)

The phosphate exploitation project in the Bled El-Hedba (Tébessa) stands out as a strategic undertaking, with an ambitious goal of producing 10 million tons of raw phosphate. This output includes 6 million tons of phosphate concentrate and the potential to create 4 million tons of agricultural fertilizers through conversion processes.

This project not only generates around 4,000 direct jobs but also provides more than 14,000 additional indirect employment opportunities. It plays a vital role in revitalizing and developing eastern Algeria, ultimately enhancing the economic performance of approximately four states in the region.

In February, the Minister of Energy and Mines, Mohamed Arkab, led a coordination meeting between the two sectors to discuss the project’s facilities and infrastructure. Subsequently, President Abdelmadjid Tebboune decided to expedite the completion of railway projects connecting Annaba to Bled El-Hedba in Tebessa Province and between Bechar and Ghara Djebilet in Tindouf Province, as reported on the Algerian Radio website.

During the meeting, a presentation highlighted the first integrated project in Algeria’s minerals and mining sector: the comprehensive phosphate project. This initiative includes the utilization of the Bled El-Hedba phosphate mine and the chemical conversion of phosphate in Oued Keberit in Souk Ahras.

3. Phosphate Exploitation Project in El Aouinet

Furthermore, the phosphate exploitation project in El Aouinet region holds significant importance within the Algerian minerals and mining sector. It is established through a local partnership between the “SONARAM” complex and the “Asmidal” complex, with a primary focus on producing materials for animal and plant nutrition.

4. Oued Amizour mine project:

Another crucial project is the Oued Amizour mine project, particularly valuable due to its substantial zinc and lead reserves. This project is essential at a time when many mines producing these minerals, such as the Al-Abed mine and Kharzat Youssef, have ceased production. The Oued Amisour mine’s estimated investment cost is approximately $400 million, making it one of the world’s top ten zinc and lead producers. Studies conducted in collaboration between the Algerian Ministry of Energy and an Australian company indicate that the mine holds reserves of 54 million tons. Among these, 34 million tons are economically viable for production, potentially yielding around 170,000 tons of concentrated zinc and 30,000 tons of concentrated lead annually for the country.

Algeria’s Ambitious Path Towards Renewable Energy Sector Advancement

Investing in renewable energy has emerged as a crucial strategy for ensuring energy security and offering a geostrategic solution to future energy challenges. Algeria’s President Abdelmadjid Tebboune, in a 2021 interview with Der Spiegel, highlighted the nation’ significant potential in renewable energy, even suggesting the possibility of supplying Europe with solar energy through German collaboration.

Algeria, as a prominent producer of natural gas and liquefied natural gas, is not resting on its laurels. The country has embarked on ambitious renewable energy and energy efficiency initiatives to expand its energy portfolio and promote sustainable development. With 86 percent of its territory covered by the Sahara desert, Algeria is uniquely positioned to harness its natural resources and position itself as a leader in renewable energy. It boasts year-round solar energy capabilities, ranking 21st globally in potential solar energy capacity.

In response to volatile oil and gas prices and increasing domestic electricity demand, Algeria has set its sights on becoming a major player in the global renewable energy market. The government has established a target of sourcing 27 percent of its electricity generation from renewable sources by 2030, with a concurrent increase in renewable generation capacity to 37 percent.

Algeria has outlined a renewable energy goal of achieving 15,000 MW of installed capacity by 2035, with an annual growth rate of 1000 MW. Additionally, approximately 1000 MW of off-grid renewable energy installations are expected to be operational by 2030, and a new energy transition law is in the works.

These objectives are integral to Algeria’s National Program for Energy Transition, embodied in “Vision 2030,” with the overarching aim of achieving sustainable energy security. This forward-looking project takes into consideration environmental sustainability, emphasizes engagement in clean initiatives that protect the environment and ocean, promotes the development of a green economy, and advocates for climate justice. In doing so, Algeria is poised to establish one of the world’s most ambitious government-led competitive renewable energy procurement programs.

Empowering a Sustainable Future: The Ministry of Renewable Energy

The government’s dedicated efforts in the field of renewable energy are starting to yield positive results. Notably, Algeria held its inaugural tender in 2019, aiming to secure 150 MW of additional renewable energy capacity. In a bid to strengthen the country’s commitment to energy transition, the Commission for Renewable Energy Transition Strategy (Cerefe) was established at the close of 2019. Additionally, in June 2020, Algeria inaugurated the Ministry of Energy Transition and Renewable Energy. A significant milestone was reached in late 2021 when METRE issued an invitation to tender for 1,000 MW of solar power capacity, expected to attract investments totaling around $800 million.

Further bolstering these initiatives, Algerian company Zergoun Green Energy inaugurated a solar panel production facility in Ouargla, boasting a capacity to produce 180 MW of solar panels. These panels will be utilized in the development of clean energy projects across Algeria, contributing to a total of 260 MW of operational solar panel production facilities in the country.

To facilitate these endeavors, Algeria has revised its tender regulations, most notably by eliminating the 51/49 rule, which previously mandated Algerian businesses to hold a majority stake in projects. To ensure Algerian involvement, a joint venture was established between Sonatrach and Sonelgaz, the two state-owned energy companies. This joint venture, known as Shaems, is permitted to hold up to a 25% stake in tender projects.

Furthermore, Algeria has engaged in numerous discussions with foreign partners from countries such as India, the United Kingdom, Belgium, Japan, and Turkey, fostering strategies and partnerships in the realm of renewable energy transition. These efforts collectively signify a significant shift toward a new national economic paradigm centered around clean and sustainable energy sources.

Algeria’s Diverse Clean Energy Resources Beyond Fossil Fuels

In addition to its abundant natural gas and oil reserves, Algeria boasts a significant portfolio of clean energy sources, further diversifying its energy landscape. Among these, hydropower stands out as the third-largest energy resource in the country, complementing its position as a global energy player. The majority of Algeria’s hydropower plants are strategically located in the northern regions, where substantial rainfall levels provide an ideal environment for harnessing this renewable energy source.

Algeria’s Ambitious Hydrogen Development Roadmap: Paving the Way for Sustainable Energy

In the realm of energy production, the near future holds the promise of a significant advancement in hydrogen production, driven by a national roadmap designed to bolster the development of this crucial energy resource. This initiative not only aims to diversify energy supplies but also accelerate the ongoing energy transition, ultimately bolstering energy security in the medium and long term.

The unveiling of the roadmap for renewable (green) and clean (blue) hydrogen development in March 2023 during the “National Strategy Workshop for Hydrogen Development in Algeria” underscores the state’s resolute commitment to hasten the energy transition while supporting a vision for nurturing a diversified and sustainable economy.

Algeria finds itself uniquely positioned to seize the mantle of a global leader in hydrogen production, capitalizing on its competitive advantages highlighted in the “National Strategy Workshop for Hydrogen Development in Algeria” document. These advantages include an abundant potential for solar energy generation, a strategic geographical location, a well-established energy infrastructure, and a burgeoning industrial base.

The document elucidates Algeria’s three-fold rationale for prioritizing the development of the hydrogen sector:

1. Exporting Cleaner Energy: Algeria aspires to emerge on the international energy stage as a primary and dependable provider of clean hydrogen.

2. Local Economic Opportunities: Hydrogen can be harnessed for diverse applications, spanning transportation, heating, electricity generation, and industrial processes. The growth of these applications presents an opportunity to launch and nurture new industrial and technological sectors within the country.

3. Boosting Renewable Energy: The cultivation of green hydrogen production capabilities will facilitate an upsurge in the proportion of renewable energy sources in Algeria’s energy mix.

To foster the hydrogen sector’s development, the document puts forth a compelling case rooted in Algeria’s distinctive geographical attributes. Algeria boasts one of the world’s most extensive solar energy resources due to its sprawling landmass and geographical location. Furthermore, the nation possesses a well-established electricity grid, an intricate network of domestic and international natural gas pipelines connecting Algeria to Europe, ample water reservoirs, thriving research institutions and universities, a burgeoning industrial landscape, and a competitive cost structure for hydrogen production.

The national roadmap for renewable and clean hydrogen meticulously caters to two distinct hydrogen categories:

– Blue Hydrogen: Derived from the conversion of methane, blue hydrogen production involves the capture and storage or utilization of carbon dioxide emissions.

– Green Hydrogen: Produced via water electrolysis using electricity sourced from renewable energy outlets, green hydrogen embodies a sustainable and environmentally friendly approach to hydrogen production.

Algeria’s Emerging Role in Global Clean Energy: Unleashing Wind and Geothermal Potential

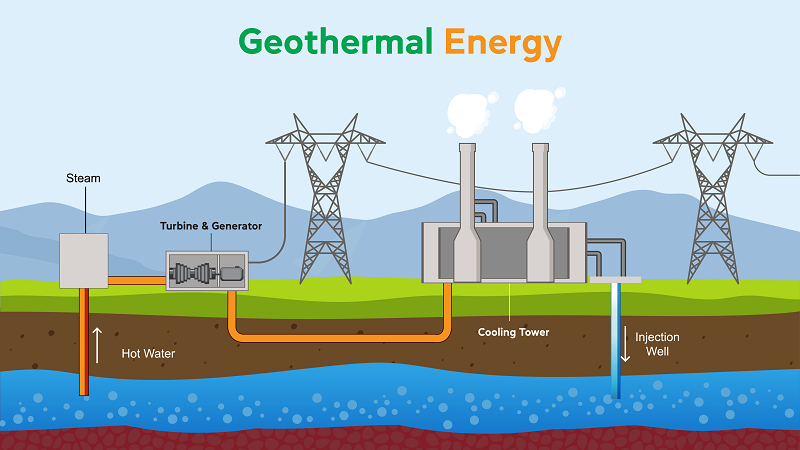

Algeria possesses untapped potential in wind energy and geothermal resources, making it a promising contender in the global clean energy transition. The country’s wind energy potential is estimated at a staggering 35 terawatt-hours per year, a testament to its vast and largely unexplored wind corridors. Demonstrating its commitment to harnessing this potential, Algeria has initiated its foray into wind power generation by establishing its inaugural wind farm in Adrar. This facility boasts an impressive installed capacity of 10 megawatts and received funding from the state utility company, Sonelgaz, showcasing the government’s dedication to sustainable energy development.

Beyond wind, Algeria holds considerable promise in geothermal energy. Situated in the north-central regions of Ouarsenis, Biban, and Kabylie are a series of thermal springs that present the ideal conditions for the establishment of geothermal power plants. This geothermal potential adds another layer of diversity to Algeria’s clean energy arsenal, reinforcing its commitment to reducing greenhouse gas emissions and mitigating the environmental impact of energy production.

Algeria’s clean energy endeavors extend far beyond its conventional fossil fuel resources. The nation’s hydropower capacity, coupled with its burgeoning wind and geothermal potential, paints a picture of a country poised to play a substantial role in the global clean energy transition.

Achieving Energy Security: Algeria’s Renewable Energy Initiatives Enhance Gas Export Expansion Strategies

Renewable energy in Algeria plays a pivotal role in addressing the country’s escalating demand for electricity while also rationalizing gas consumption to fulfill export commitments. The escalating domestic energy consumption in Algeria has emerged as a pressing concern for the government, particularly since a substantial portion of this energy, encompassing both electricity and gas, is channeled towards non-productive sectors.

To tackle this mounting energy consumption challenge, the Algerian government has embraced renewable energy solutions. This strategic move is aimed at alleviating the strain of surging domestic consumption, bolstering energy transformation initiatives, and curbing emissions.

Gas utilization in Algeria is substantial, with the country annually consuming 45.87 billion cubic meters of natural gas across various sectors. Of this, 45% is allocated to electricity production, equivalent to 20.79 billion cubic meters. Gas also contributes to generating 39.793 gigawatts of electricity annually, representing a substantial 54% of the national electricity production of 73.796 thousand gigawatts per year.

Approximately 32% of Algeria’s gas production caters to the population’s needs, amounting to 14.888 billion cubic meters of gas, which further generates 29,352 gigawatts of electricity, constituting 40% of the total national production. Meanwhile, 23% of the gas production is directed towards the industrial sector, utilizing 10.183 billion cubic meters and producing 10,183 gigawatts of electricity, equivalent to 40% of the total national production.

The remainder of electricity production is distributed to other sectors, with the agricultural sector receiving 3,003 gigawatts (4% of total production), and the transportation sector receiving just 2%, benefiting from 1,648 gigawatts of electricity generated from gas.

In an effort to reduce gas consumption and support the country’s gas export goals, Sonelgaz, in collaboration with the Ministry of Energy and Mines, has initiated a comprehensive renewable energy program in Algeria. This program encompasses several key strategies:

1. Energy-saving measures, energy efficiency improvements, and the rationalization of energy consumption.

2. Implementation of modern construction techniques and enhanced insulation to reduce energy usage.

3. Promoting the use of electricity in mass transportation (e.g., buses and metro) instead of conventional fuel.

4. Encouraging the conversion of a wide range of vehicles to use liquefied petroleum gas (LPG) as a cost-effective and readily available alternative, with a gradual shift towards electric vehicles.

5. Reviewing energy pricing and subsidy policies to discourage wasteful consumption.

6. Executing a national program to generate 15,000 megawatts of renewable energy in Algeria, alongside the development of a green hydrogen program for production, storage, and utilization.

Sonelgaz has outlined a plan to implement a 15,000-megawatt renewable energy program in Algeria from 2024 to 2035. This program aims to reduce gas consumption by approximately 40 billion cubic meters during this period. The plan involves identifying 46 locations across 212 production sites, distributed across high and medium voltage lines, with 12,500 megawatts transmitted on the high voltage (HTB) network and 2,500 megawatts on the medium voltage (HTA) network. The estimated total electricity production during this period is 168 terawatts, with an annual average of 14 terawatts.

To advance the renewable energy agenda in Algeria, Sonelgaz has initiated a program to establish 15 solar energy stations, with a combined capacity of 2,000 megawatts. These stations, part of the broader 15,000-megawatt renewable energy program, have undergone a rigorous selection process, with 73 out of 77 offers meeting legal requirements. These stations are distributed across various states, with capacities ranging from 80 to 350 megawatts.

Algeria’s Comprehensive Approach to Ensuring Long-Term Energy Security

In line with the government’s overarching policy statement for 2023, Algeria is steadfastly committed to safeguarding its long-term energy security, optimizing fuel resources, bolstering mineral supply to key economic sectors, and sustaining export levels vital for financing the national economy. This commitment extends into the domains of electricity and natural gas distribution, emphasizing the pivotal role of energy in wealth generation, employment opportunities, agricultural development, and investor attraction. The government’s multifaceted strategy includes:

1. Enhanced Electricity Production: Adding an additional 600 megawatts of electricity generation capacity to meet growing demands.

2. Infrastructure Strengthening: Completing 5,000 kilometers of electrical transmission and distribution networks and establishing 1,260 electrical and similar stations, along with 805 kilometers of gas pipelines and 119 gas stations. This effort aims to connect 12 new sites to the electrical grid and 28 locations to the natural gas network, especially in emerging urban areas.

3. Support for Investors: Facilitating the connection of 1,100 investors to the electrical grid and 437 to the gas supply, fostering an environment conducive to economic growth.

4. Industrial Expansion: Linking 28 industrial zones to the electricity grid and 100 areas to natural gas to stimulate industrial activity and economic diversification.

5. Rural Electrification: Completing 3,047 electrical projects in remote and underserved regions, enabling nearly 198,780 households to access electricity and extending natural gas connections to 2,770 projects, thereby benefiting 276,304 homes.

In tandem with these endeavors, Algeria is actively promoting the development of renewable and novel energy sources:

1. Solar Energy: Launching a 10 MW solar photovoltaic station and initiating the Solar Laboratory “Lab” project. Moreover, 28 out of the planned 50 megawatts for the hybridization program in the southern regions have been completed. This results in a total renewable energy capacity of 660 megawatts.

2. Energy Access: Allocating 3,055 billion dinars in 2023 to connect isolated regions to electricity through small solar energy networks. This includes equipping 2,000 homes with photovoltaic solar energy kits, with a particular focus on newly established regions. Additionally, 5,000 solar photovoltaic lighting points will be deployed for public lighting.

3. Ministry of Environment: Committing 50 million dinars to equip two Ministry of Environment and Renewable Energy structures with solar photovoltaic energy solutions.

4. Public Lighting: Manufacturing 7,000 photovoltaic lighting units for public lighting installations across new cities in the residential sector.

Energy efficiency remains a paramount concern:

1. Vehicle Conversion: Aiming to convert 71% of a targeted 150,000 vehicles to run on liquefied natural gas, reducing emissions and promoting cleaner transportation.

2. Industrial Efficiency: Implementing energy-efficient practices in 71% of the 39 targeted industrial projects, significantly reducing flammable gas emissions from 79% to a mere 3%.

3. Gas Conservation: Achieving a savings of 44 million cubic meters of natural gas in 2022, primarily through completed renewable energy generation projects and the adoption of combined cycle power generation plants.

Furthermore, Algeria is embarking on an ambitious national hydrogen plan, involving comprehensive measures such as:

1. Hydrogen Strategy: Developing a comprehensive document outlining the national strategy for hydrogen development in the short, medium, and long term.

2. Promotion and Awareness: Initiating a communication and dissemination plan to promote the national hydrogen strategy, including workshops and educational webinars.

3. Human Resource Development: Strengthening human resources by introducing university training programs in hydrogen-related fields, hosting expert workshops in collaboration with the European Union to enhance knowledge in renewable hydrogen production.

4. Pilot Projects: Identifying and launching pilot projects to kickstart the hydrogen sector’s development.

Algeria’s holistic approach to energy security, encompassing electricity and gas infrastructure, renewable energy expansion, efficiency improvements, and hydrogen innovation, underscores its unwavering commitment to ensuring a sustainable and resilient energy future.

Algeria, Europe’s Crucial Energy Source in the Aftermath of the Russian-Ukrainian War

In the wake of the conflict between Russia and Ukraine, Europe initiated efforts to diversify its energy sources in order to reduce its heavy reliance on Russian gas, which previously held a substantial 40 percent share of the European energy market. In the midst of this global energy crisis, Algeria’ strategically advantageous geographical location has emerged as a pivotal factor in the search for alternative energy resources. Situated in North Africa along the southern Mediterranean coast, Algeria’s geographic positioning has conferred upon it a unique and central role in the worldwide energy landscape.

Thanks to its geographical advantages, abundant resource potential, well-thought-out strategic planning, and relative stability in a region often characterized by turbulence, Algeria has emerged as a dependable conduit for the Nigeria-Europe pipeline. Its geographical centrality places it firmly within the realm of European and even American interests, particularly in terms of ensuring energy security for their European partners. This significance is underscored by Algeria’ substantial contribution, exceeding 14 percent of the total gas exports to Europe, and exceeding 30 percent for the Italian and Spanish markets.

Subsequently, European officials embarked on diplomatic missions to Algeria with the aim of securing a stable and secure supply of energy resources.

Josep Borrell, the High Representative for Foreign Affairs and Security Policy in the European Union, visited Algeria in March 2023 and praised the country as a reliable energy partner, particularly during the tumultuous times triggered by the Russian-Ukrainian crisis.

Italy, too, recognized the urgency of securing its energy needs and turned its attention to Algeria. This led to the signing of several agreements aimed at guaranteeing energy supplies and increasing Italy’s share of these resources.

Italian President Sergio Mattarella, during his visit to Algeria in November 2022, affirmed that Algeria, as Italy’ second-largest gas supplier, would remain a pivotal partner in the field of energy cooperation. President Abdelmadjid Tebboune of Algeria echoed this sentiment by emphasizing Algeria’s reputation as a dependable gas supplier that consistently fulfills its contractual obligations.

Algeria’s policy of non-alignment has enabled it to maintain balanced relations with all its energy partners. In alignment with this approach, Algeria’ state-owned energy company, Sonatrach, announced plans in February 2022 to conduct exploration operations for 24 new gas wells, in collaboration with Russia’s Gazprom, with production slated to commence in 2025.

Algeria’s Resilience as a Stable Energy Source: A Multifaceted Approach

Algeria stands out as a dependable and steadfast energy provider, a reputation it has earned through various notable factors. Foremost among these is its unwavering commitment to ensuring energy supplies, even during challenging periods, such as the tumultuous black decade crisis of the 1990s. This steadfastness can be attributed to Algeria’s prudent and pragmatic decision-making in upholding its contractual obligations with European partners while maintaining a consistent approach in its dealings with all collaborators. A compelling illustration of this commitment is Algeria’s response to a diplomatic rift between Algeria and Spain. Despite this strain, Algeria honored its contractual commitments without resorting to supply disruptions or using energy as a bargaining chip.

Furthermore, Algeria has implemented a comprehensive plan to safeguard its energy-related infrastructure, thanks to the considerable human and material resources provided by the People’s National Army of Algeria. This holistic strategy not only acknowledges the unique challenges and risks within the region but also aligns with international standards. Algeria has taken proactive measures to secure its vital infrastructure, as exemplified by its response to a significant terrorist threat, Operation Tiguentourine, which aimed to undermine the nation’s economic lifeline. In this critical situation, Algeria effectively employed “hard power” to protect its facilities, ensuring energy security in the face of imminent threats.

In recent times, Algeria reaffirmed its commitment to energy security during a high-level coordination meeting commemorating the anniversary of Tiguentourine. At this gathering, it was underscored that Algeria has both a well-defined security plan and a comprehensive strategy in place to safeguard its energy facilities. These measures solidify Algeria’s position as an active and reliable partner in the global energy landscape.

Algeria Poised to Lead the Clean Energy Revolution in Africa

A recent Spanish report has identified Algeria as one of the leading African nations endowed with abundant renewable energy resources. This recognition positions Algeria as a major contender in the production of clean energy, particularly evident through its ambitious national strategy for green hydrogen. This strategic initiative is set to make Algeria a global hub for green hydrogen projects.

According to the report published in the Spanish magazine “cambio16,” Algeria stands at the forefront of countries naturally predisposed to harness and scale up clean energy production while also attracting related projects. The vast potential for clean energy in Algeria is acknowledged as a valuable asset on the global stage.

The report further underscores that Algeria’s expected production of green hydrogen aligns with the international trend toward alternative fuels, driven by a collective desire to mitigate environmental impacts and combat climate change. Algeria, along with several other leading African nations in this field, is poised to lead the way in producing and utilizing hydrogen derived from renewable sources, thereby reducing reliance on fossil fuels. This shift towards a green economy is increasingly seen as essential for European countries to address the pressing challenges of climate change and environmental sustainability.

Sonatrach Secures Top Spot Among 500 African Companies in Jeune Afrique’s Latest Report

In the most recent report by the magazine Jeune Afrique, Sonatrach proudly clinched the coveted first position in Africa. This remarkable achievement was based on an exhaustive evaluation of 500 prominent African companies, all analyzed according to a comprehensive set of economic criteria, primarily revolving around their turnover.

Sonatrach, in an official statement posted on its Facebook page, shared the news of its top-ranking position, underscoring the rigorous assessment process employed by Jeune Afrique. Notably, this prestigious recognition reaffirms Sonatrach’s dominance in the African business landscape, solidifying its stature as a formidable industry leader.

Furthermore, the report also shed light on the outstanding performance of Sonatrach’s subsidiary, Naftal, which secured an impressive sixth place among the largest companies in North Africa. This dual success highlights Sonatrach’s unwavering commitment to excellence and its continued contribution to the region’s economic growth and stability.

Algeria’s Energy Sector Transformation: A Path to Sovereignty and Prosperity

In conclusion, the energy reform promised by President Abdelmadjid Tebboune upon his election in 2019 holds immense significance for Algeria’s energy independence and sovereignty. This commitment has materialized into a comprehensive restructuring of the nation’s oil and gas sector, resulting in increased investments from International Oil Companies (IOCs). Under the guidance of Minister of Energy and Mines, Mohamed Arkab, acting on President Tebboune’s directives outlining the national energy policy, this sector has achieved notable successes despite the challenges posed by the global health crisis.

These accomplishments encompassed the signing of contracts and MoUs with foreign partners, successful exploration and replenishment of reserves, the initiation of new gas projects and infrastructure development, and the significant milestone of diesel and gasoline exports, a first in a decade. Concurrently, Sonatrach, Algeria’s national oil and gas company, embarked on substantial projects and expanded its involvement in pivotal ventures. These collective achievements have ushered in profound and positive changes in hydrocarbon production, utilization, and petrochemical development.

These accomplishments serve as promising indicators for Sonatrach as it prepares to confront future challenges with confidence. Presently, the company continues to devote relentless efforts to address contemporary and forthcoming challenges, including the mobilization of new reserves, expansion in refining and petrochemicals, and active participation in the country’s economic and energy development.

These endeavors outline the company’s objectives, which include tapping into new oil and gas reserves through various field development projects, such as Touggourt, Hassi Bi Rekaiz, and Berkine Sud for oil, and Isarene, TFT, and the fields of South-West for gas. Furthermore, Sonatrach aims to enhance refining capabilities by constructing a new refinery in Hassi Messaoud and a fuel conversion unit at the Skikda refinery. The plan also entails the expansion of petrochemicals, with a particular focus on the production of Methyl Tert Butyl Ether (MTBE) in Arzew, Linear Alkyl Benzene (LAB) in Skikda, and a polypropylene production complex in Arzew, in collaboration with Total Energies. Additionally, discussions with partners for significant projects in the upstream and petrochemical sectors remain ongoing.

Turning to the realm of renewable energy, Algeria has positioned itself as a key player in the energy transition for North Africa and beyond. It has launched ambitious initiatives to deploy large-scale renewable energy generation projects and foster local manufacturing capacity.

In light of the aforementioned developments, it is clear that Algeria’s energy sector, which serves as the nation’s all-encompassing insurance and the lifeblood of its economy, has demonstrated its pivotal role as the launchpad for a New Algeria. This emerging Algeria aspires to achieve industrial prowess and energy security, recognized as one of the most critical global challenges and a fundamental component of comprehensive national security. Through a comprehensive analysis across five dimensions—Availability, Affordability, Applicability, Acceptability, and Governance—it becomes evident that the sector is progressing in the right direction. It not only caters to domestic energy needs but also secures exports abroad, thanks to Algeria’s abundant natural resources. Thus, the national petro-gas company, Sonatrach, stands as a bulwark safeguarding Algeria, alongside its armed forces, activists, and citizens, as aptly stated by President Tebboune: “Sonatrach is one of the powerful levers of national sovereignty. It is the shield that protects Algeria after its armed forces, activists, and citizens.”